At the beginning, I intended to do as in my previous analyzes, spend some time on the Explorer to find the newly created wallets participating in the Launchpad and gradually go back to the wallets from which the funds came; or simply wait for the tickets to be distributed in order to find the biggest holders directly and dive into the sprawling tree of wallets from which they received the recently farmed tickets (you will understand later).

But I said to myself that we could do better and above all in a much more macroscopic way to have the most complete data possible.

So I took my little knowledge of python to make API calls to retrieve all the transactions made in $ASH from the top 10K holders (limit set by the API). Limit that didn't bother me too much because in the end, after 10k holders, there were only about 16,000 accounts left with 1 winning ticket and therefore very little chance that they used several wallets.

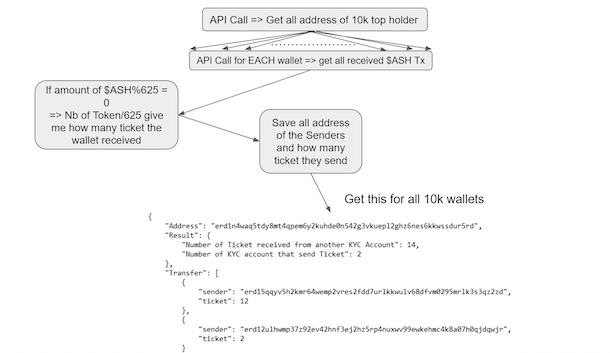

I will spare you the details of my code, it would be tedious for nothing, but I made you an algorithmic diagram to understand how I could differentiate the wallets having farmed from the others:

So I collected all incoming transactions from each of the 10k wallets and only kept the wallets that received full tickets ($650 ASH/tickets) freeing all others from suspicion (not out of goodness, but that would have added too much noise to the data).

Now we must ensure the validity of the data, a wallet that sends a ticket to another does not mean that the person behind these two accounts participated twice, we must check that the receiving wallets also participated in the Launchpad. It is also necessary to make sure that I have not counted certain tickets twice, for example if the sending account had itself received the tickets from another account (I have seen this principle repeated from 2 to 6 times for some accounts, trying to blur the imo tracking).

There are other special cases to take into account but I will not detail everything in writing, but here is what the algorithmic logic looks like to analyze the data to ensure its validity:

it would have been much easier to start with the wallets of the senders than with those of the recipients, but the 10k limit of the API obliges me to do so and looking at the large wallets in priority remains more efficient. Before presenting the results, why bother with all these loops? In order to estimate the number of accounts used! On the other hand, this is not necessary to know the number of tickets transferred from an account already KYC.

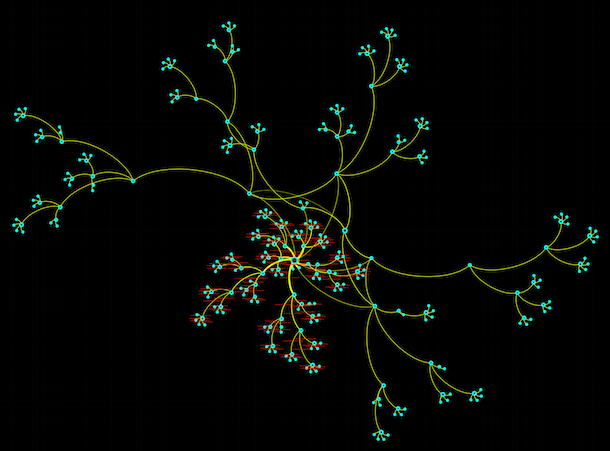

Why do you absolutely want to know the number of accounts used? Already by rigor but especially to show you this account and the mesh of the secondary accounts used:

The focal point you see is a wallet that has collected a total of 240 tickets for a total of 150k $ASH and $LKASH!

All the ramifications are the wallets that sent them tickets, we see that it is gradually centralizing the tokens rather than sending everything directly to the main account in order, I think, to complicate tracking as much as possible.

Nice try, but nothing can escape the lightning haha

But let's not cry foul too soon, I think it's very likely that this is what we could equate to a DAO, a company, a venture capital or other. It is very unlikely in my opinion that this is the action of a single person, in total more than 320 accounts have been used, I do not see how this entity could KYC so many accounts if it was not a meeting of a hundred people and it is a pattern that we find on many accounts with a large bag of $ASH finally.

But the diagram presented above only represents the accounts that sent $ASH (and therefore won tickets), but fortunately the same logic was used to return the unused EGLDs of the losing tickets and wallets, in full, the octopus looks more like this!

"Sprawling, isn't it?"

In the middle, where we see the red labels of the wallets, the winning accounts, all the others are accounts that have not won anything. All the funds come from Okex, and end up on Binance, the 150k $ASH won, ended up in Price Discovery and the 300 $EGLD won should, a priori, also end up on Binance.

We are therefore witnessing more vampirism and the entry of new capital into the Elrond ecosystem.

Now the total results:

7685 tickets from 3390 wallets were sent to 1088 accounts that had previously participated in the Launchpad. This includes large wallets as shown above, as well as small ones that used for example 2 KYC accounts. It should be understood that this figure is a low estimate, I have maximized the verifications mentioned above in order to avoid any false positives even if it means missing certain accounts (in particular those having sent amounts of tokens not corresponding to whole tickets) . But impossible to count the accounts belonging to a single person who used several KYCs and did not centralize their acquired $ASH (or who did so after my data recovery).

Personally and given the rather drastic KYC put in place, I don't think there is any verification problem, the majority of tickets purchased have been purchased by individuals who, I suppose, have used the KYCs of their relatives or by DAOs/Entities using bots to facilitate and automate their participation. On the other hand I think we see a lot of vampirism coming from some players outside the Elrond ecosystem, we can see a massive representation of these wallets centralizing several winning tickets among the biggest holders and they are a majority for sale in Price Discovery or on Jexchange compared to Whales who buy, which creates a significant imbalance between supply and demand.

This results in two things in my opinion. The poor performance of this Launchpad, and that the biggest holders following the distribution of tickets are Whales with a short-term vision and not capital looking for a long-term investment.

Of course, take the numbers with a pinch of salt, we can't rule out some errors and the lack of some data, but I estimate the accuracy of these results at + or - 5% on the strategy tested.

In conclusion :

I'm not sure what to make of all the people who use multiple KYC's it's legally wrong to use other people's KYC's for investing so it's at their own risk but should we consider this normal and do as them ? It's a bit like sports and drugs; knowing that 10% of cyclists dope, should we allow doping to put them all on an equal footing? It's up to you to make the choice, either you want to stay honest and you're afraid of the potential legal risk in case of using your grandmother's KYC (even if I don't see what could really happen to you) or else you decide to put more luck on your side like say 10% of the participants.

Finally know that we can never avoid individuals who use the KYC of their relatives, however, I think it is crucial to do something against vampire Wallets, who create new accounts, stack a little EGLD at the announcement of Beniamin Mincu and leave as soon as the gains are made.

1 week of snapshot is not enough, the community needs an eligibility system rewarding the real actors and owners of the ecosystem. A long-term snapshot should be made, better rewarding permanent stackers and avoiding opportunistic wallets while increasing participation and new arrivals in the ecosystem.

A snapshot weighted with the stacking time would in my opinion be a good idea if we stay on an average of a Launchpad every 3/4 months:

- If you stack your $EGLD since the last Launchpad, you will be able to buy 100% of the tickets available for your Tier

- If you have been stacking for only one week, you can only buy 25% of the tickets, for example 1 ticket for Tier 5

It would allow :

- Newcomers to participate

- An appreciation of the price of $EGLD by opportunistic portfolios which buy more ELGD to compensate for the drop in allocated tickets or a longer-term participation in the stacking

- Increase the number of permanent stackers and better reward them

Thank you for reading, I hope you enjoyed this little report and I will continue to improve the analysis for the next Launchpad, my goal is to redo these graphs of networks but containing ALL the portfolios that participated in the Launchpad linked to Smart Ticket distribution contract, it could be nice to see in addition to allowing a real macro view of the magnitude of this kind of account on the Launchpad.

Your best thank you is sharing my work, thank you for the strength you bring me during my threads and analysis!

See you next ⚡

Thread by Foudres

Tweet Share

You can check if you are not dealing with a scam

Check now

@elrondwiki.elrond

@elrondwiki.elrond