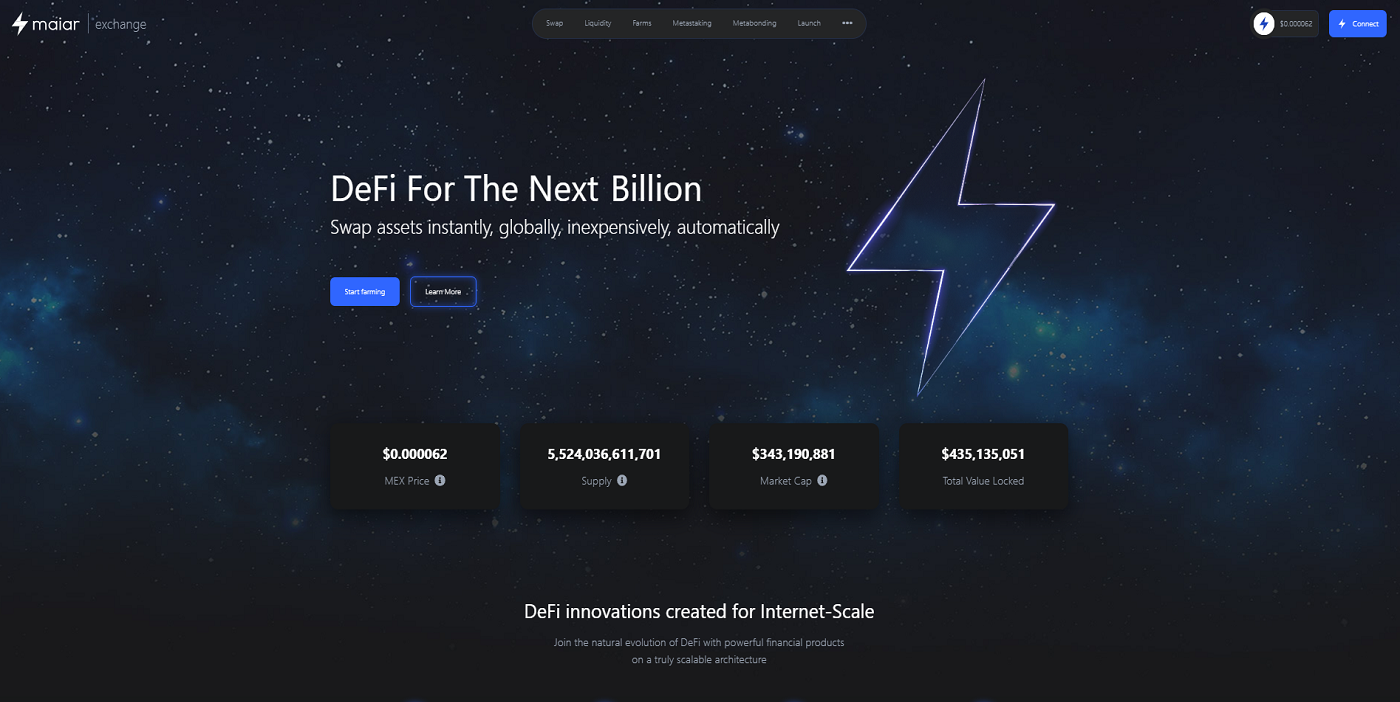

Introducing Maiar Exchange: The Scalable Financial Engine of The New Internet Economy

In the past few years, we have witnessed the surge of decentralized financial products that enhance sovereignty and evade the shortcomings of the traditional system. The impressive rise of DeFi proves the growing appetite for modern finance.

As a new Elrond-based decentralized application, Maiar Exchange will contribute to the future of DeFi. Maiar is a user-friendly, highly efficient, and secure DEX. Its launch facilitates the Elrond ecosystem growth and offers investors opportunities to generate passive income.

Maiar's scalability, speed, and affordability remove the entry barrier for DeFi trading platforms and bring an era of financial sovereignty to a billion people.

What is Maiar Exchange?

Maiar Exchange is a liquidity pool-based DEX or AMM based on the Elrond blockchain. It allows users to deposit their funds to a pair or pool of assets. By doing so, users become liquidity providers and earn a fee (MEX) for each swap transaction performed in that pool.

Users access a core functionality without intermediaries. They fully control their assets in wallets and benefit from investments.

Maiar also offers high bandwidth, low latency, and cheap transactions.

What are Maiar Exchange's Features?

Powered by Elrond

Maiar's users benefit from Elrond architecture and near-instant, inexpensive transactions.

Elrond has already implemented network and transaction sharding. The blockchain runs on over 3200 validator nodes split into four shards. Each delivers 5,400 transactions per second.

The architecture is adaptive and can scale by adding new shards.

Usability and Privacy

You can access Maiar Exchange via Elrond's Maiar app and sign transactions from your mobile phone. The application is user-friendly: for instance, creating a wallet via a phone number takes several seconds.

Nevertheless, the app will not store your phone number. The system only uses its hash once while creating an account.

Semi-Fungible Token

SFTs are tokens that can be both fungible and non-fungible (NFT) during their lifecycle. Initially, SFTs act like regular fungible tokens and can be traded like-for-like with identical SFTs. Once they are redeemed, however, they lose exchangeable value, turning into NFT. This system allows liquidity providers to receive tradeable LPs tokens and use them as collateral for a loan or to provide liquidity and then sell their position.

MEX: Maiar Exchange Token

MEX is a native Maiar Exchange token. Its primary function is to incentivize users to provide liquidity. It has a broad distribution and compelling economics.

MEX is also used for Maiar's governance.

What Can You Do With Maiar Exchange?

Maiar allows users to buy, sell, exchange, and stake digital assets.

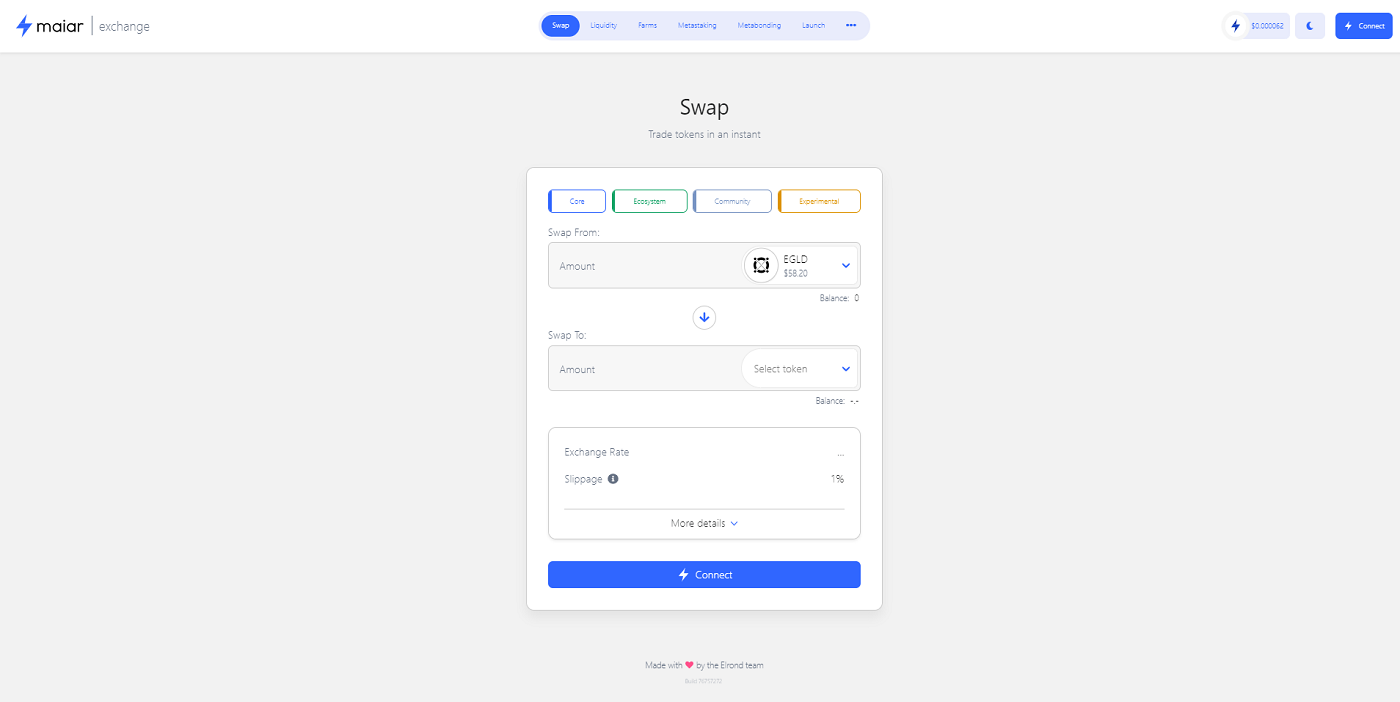

Swapping

Swapping means exchanging one digital asset for another for a given price. On Maiar exchange, assets are swapped in liquidity pools.

The exchange supports 14 assets:

- EGLD

- MEX

- USDC

- WEGLD

- AERO

- BHAT

- CRU

- EFFORT

- ISET

- ITHEUM

- RIDE

- UTK

- WAM

- ZPAY

Liquidity Pools

Liquidity pools are token reserves on DEX's smart contracts and are available for exchange.

Liquidity providers earn fees from swaps in their pool. They can access and withdraw their tokens anytime, even if the prices and overall liquidity fluctuate.

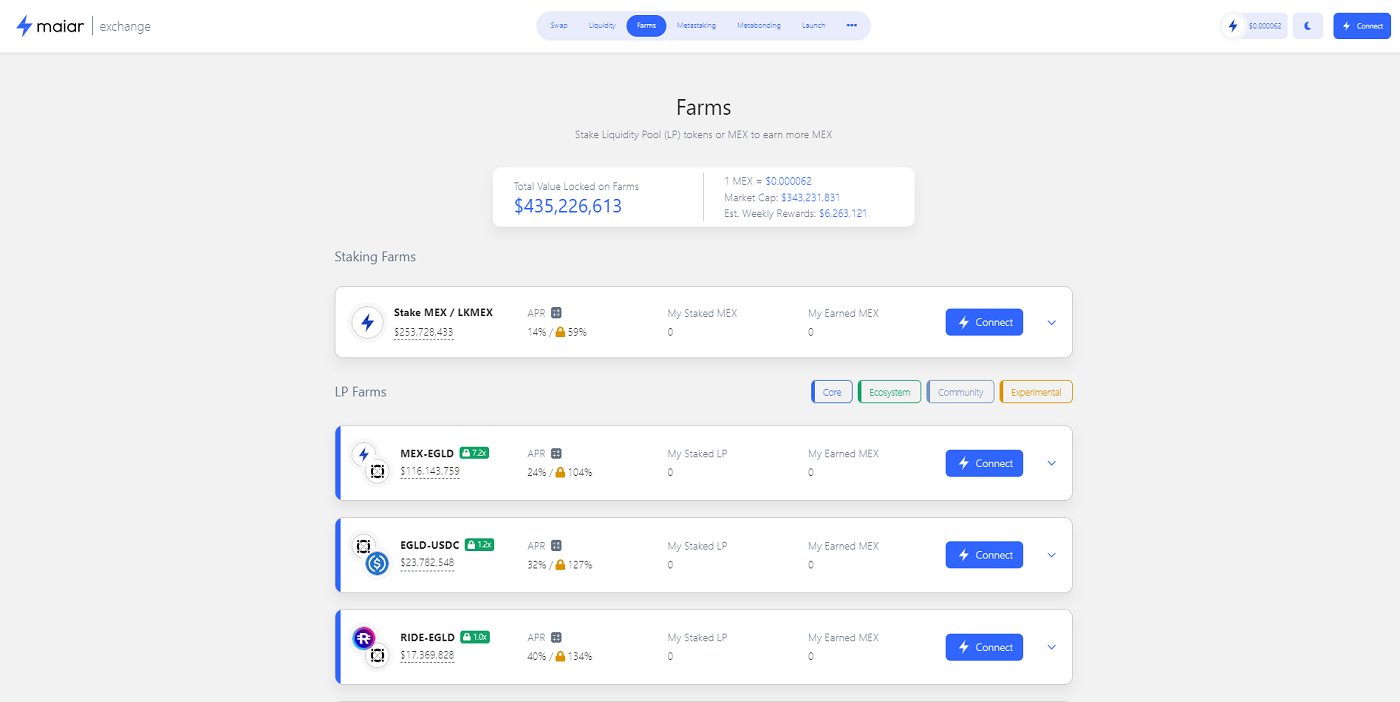

Farming

Farming is an additional incentive mechanism for liquidity providers that creates a positive feedback loop. Farmers can lock their liquidity and receive rewards. On Maiar exchange, farming is rewarded with MEX. Thus, farmers can influence the exchange's governance.

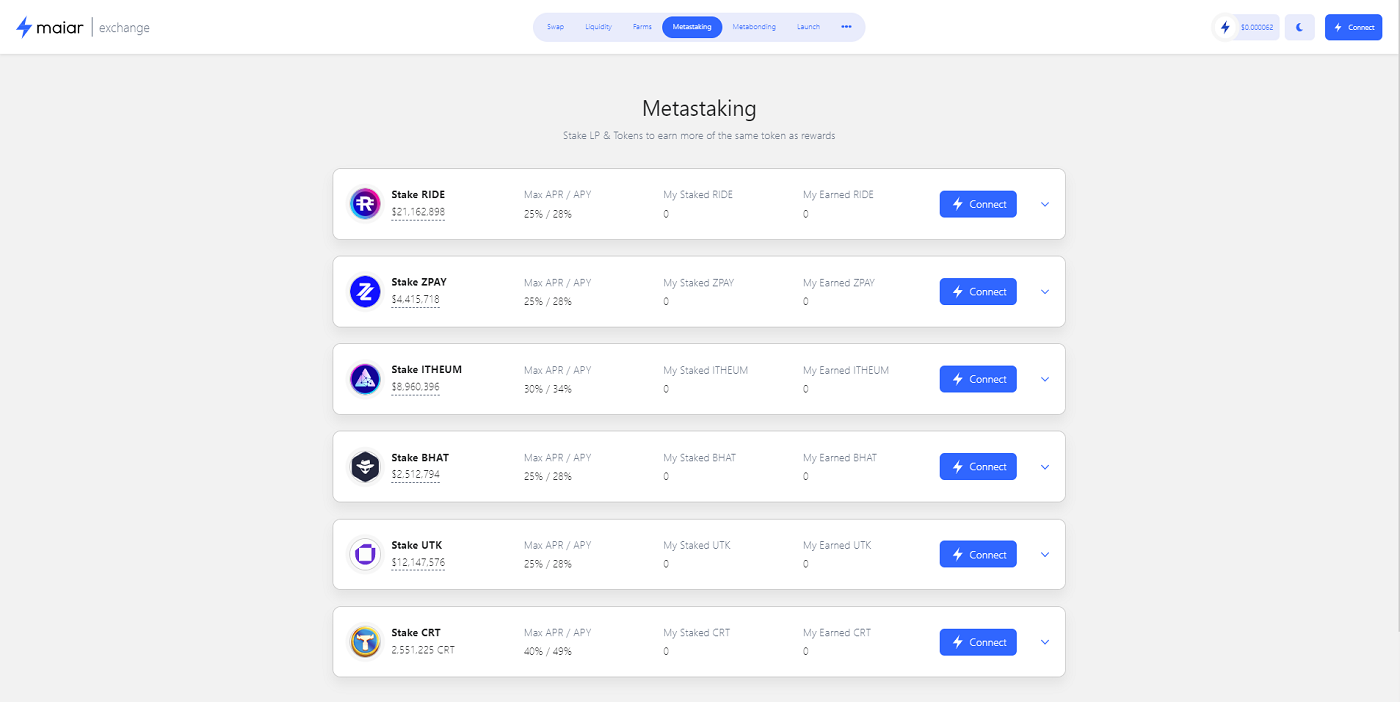

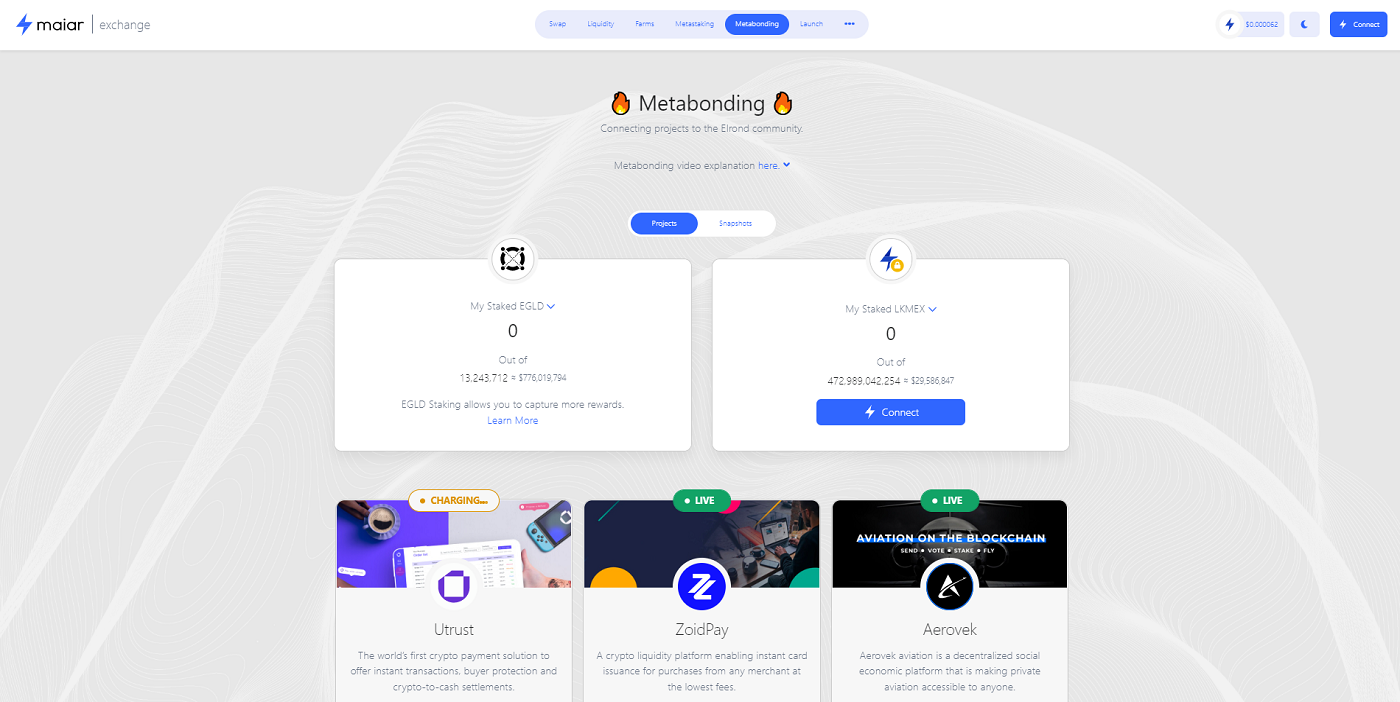

Metastaking and Metabonding

The exchange offers two unique features for the Elrond ecosystem: metastaking and metabonding. The former aims to use LP token swaps to increase liquidity: users swap liquidity pool tokens and receive fee rewards.

As for metabonding, its goal is to create a strong relationship between Elrond-based projects and long-term holders. Metabonding and metastaking benefit both network participants and the project itself — read our detailed overview for the whole picture.

What Else Should You Know Before Getting Started?

Something that everyone using an AMM should keep in mind is Impermanent Loss (IL). IL describes a temporary loss of funds that liquidity providers can experience due to volatility in a trading pair, which is more likely to occur during an unstable market.

IL can happen when a token rebalancing formula creates an imbalance between a price of an asset within a liquidity pool and outside of it. If the value of deposited assets changes, the LP could be exposed to impermanent loss.

It only becomes apparent once one withdraws from a pool. However, the fees might cover the loss in some cases.

Conclusion

Maiar is an AMM built on the scalable Elrond blockchain. Compared to other DEXs, Maiar provides faster and cheaper transactions and a seamless user experience. These characteristics open the gates of DeFi to a broader public and allow for a proliferation of new use cases.

You can check if you are not dealing with a scam

Check now

@elrondwiki.elrond

@elrondwiki.elrond